Example usage code

To help you get started, here are a few minimalist .NET 8.0 C# projects that you can review. They are complete working examples.

ConsoleAppis a minimalist example of how to use the library (start here)Backtestis a slightly more complicated example of how to analyze resultsCustomIndicatorsLibraryshows how you can create your own custom indicatorsCustomIndicatorsUsageshows how you’d use a custom indicator just like any other in the main libraryObserveStream[preview] shows how you’d use live quotes from WebSocket, using the Alpaca SDK for .NETUseQuoteApishows how you’d get quotes from an API quote source, using the Alpaca SDK for .NET

For more information on how to use this library overall, see the Guide and Pro Tips.

Getting started with our sample projects

We use an external API quote source for our streaming and quote API examples. If you intend to run those locally, you’ll need to get a free Alpaca API key and secret, then set your local environment variables.

Run the following command line items to set, after replacing the MY-ALPACA-KEY and MY-ALPACA-SECRET values; then restart your IDE.

# use your own keys

setx ALPACA_KEY "MY-ALPACA-KEY"

setx ALPACA_SECRET "MY-ALPACA-SECRET"

Get and run the sample projects

- Download the ZIP file and extract contents

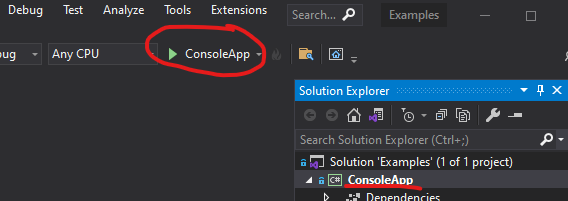

- Open

Examples.slnin Visual Studio - Review the code in the

Program.csfile(s) - Run the

ConsoleAppor any other project with one of the following methods:- select (will be bold in Solution Explorer) and press the

CTRL+F5key - execute

dotnet runCLI command in theConsoleAppproject folder -

clicking the play button

- select (will be bold in Solution Explorer) and press the

Backtest example

/* This is a basic 20-year backtest-style analysis of

* Stochastic RSI. It will buy-to-open (BTO) one share

* when the Stoch RSI (%K) is below 20 and crosses over the

* Signal (%D). The reverse Sell-to-Close (STC) and

* Sell-To-Open (STO) occurs when the Stoch RSI is above 80 and

* crosses below the Signal.

*

* As a result, there will always be one open LONG or SHORT

* position that is opened and closed at signal crossover

* points in the overbought and oversold regions of the indicator.

*/

// fetch historical quotes from data provider

List<Quote> quotesList = GetQuotesFromFeed()

.ToList();

// calculate Stochastic RSI

List<StochRsiResult> resultsList =

quotesList

.GetStochRsi(14, 14, 3, 1)

.ToList();

// initialize

decimal trdPrice = 0;

decimal trdQty = 0;

decimal rlzGain = 0;

Console.WriteLine(" Date Close StRSI Signal Cross Net Gains");

Console.WriteLine("-------------------------------------------------------");

// roll through history

for (int i = 1; i < quotesList.Count; i++)

{

Quote q = quotesList[i];

StochRsiResult e = resultsList[i]; // evaluation period

StochRsiResult l = resultsList[i - 1]; // last (prior) period

string cross = string.Empty;

// unrealized gain on open trade

decimal trdGain = trdQty * (q.Close - trdPrice);

// check for LONG event

// condition: Stoch RSI was <= 20 and Stoch RSI crosses over Signal

if (l.StochRsi <= 20

&& l.StochRsi < l.Signal

&& e.StochRsi >= e.Signal

&& trdQty != 1)

{

// emulates BTC + BTO

rlzGain += trdGain;

trdQty = 1;

trdPrice = q.Close;

cross = "LONG";

}

// check for SHORT event

// condition: Stoch RSI was >= 80 and Stoch RSI crosses under Signal

if (l.StochRsi >= 80

&& l.StochRsi > l.Signal

&& e.StochRsi <= e.Signal

&& trdQty != -1)

{

// emulates STC + STO

rlzGain += trdGain;

trdQty = -1;

trdPrice = q.Close;

cross = "SHORT";

}

if (cross != string.Empty)

{

Console.WriteLine(

$"{q.Date,10:yyyy-MM-dd} " +

$"{q.Close,10:c2}" +

$"{e.StochRsi,7:N1}" +

$"{e.Signal,7:N1}" +

$"{cross,7}" +

$"{rlzGain + trdGain,13:c2}");

}

}

Console output

Date Close StRSI Signal Cross Net Gains

-------------------------------------------------------

1999-11-01 $1,354.12 92.0 97.3 SHORT $0.00

1999-12-01 $1,397.72 14.6 4.9 LONG ($87.20)

1999-12-28 $1,457.66 96.9 97.6 SHORT $76.28

2000-01-06 $1,403.45 5.2 2.9 LONG $124.76

2000-02-09 $1,411.71 63.4 80.3 SHORT $87.07

2000-02-22 $1,352.17 9.3 6.0 LONG $197.89

2000-03-06 $1,391.28 77.8 92.6 SHORT $216.57

2000-04-06 $1,501.34 22.0 7.3 LONG ($42.66)

2000-05-17 $1,447.80 77.6 92.5 SHORT ($39.68)

2000-05-24 $1,399.05 33.8 19.8 LONG $111.36

2000-06-05 $1,467.63 89.9 96.1 SHORT $199.77

2000-06-26 $1,455.31 29.8 9.9 LONG $155.83

2000-07-14 $1,509.98 100.0 100.0 SHORT $252.85

2000-07-25 $1,474.47 18.9 14.3 LONG $269.20

2000-08-09 $1,472.87 82.5 90.9 SHORT $230.49

2000-09-07 $1,502.51 29.4 18.2 LONG $172.81

2000-10-23 $1,395.78 99.0 99.7 SHORT ($11.01)

2000-11-14 $1,382.95 45.2 15.1 LONG $121.38

2000-12-12 $1,371.18 89.0 94.1 SHORT $85.01

2000-12-18 $1,322.74 34.5 34.4 LONG $193.66

2001-01-05 $1,298.35 58.2 81.8 SHORT $96.44

2001-02-09 $1,314.76 0.0 0.0 LONG $88.01

2001-03-09 $1,233.42 46.1 74.1 SHORT ($58.26)

2001-03-13 $1,197.66 36.0 27.4 LONG $94.60

2001-03-28 $1,153.29 72.7 79.1 SHORT ($29.90)

2001-05-15 $1,249.44 12.0 10.9 LONG ($177.83)

2001-05-18 $1,291.96 100.0 100.0 SHORT $3.36

2001-05-31 $1,255.82 10.4 3.5 LONG $33.12

2001-07-05 $1,219.24 57.2 83.8 SHORT ($76.18)

2001-07-12 $1,208.14 71.5 23.8 LONG ($17.40)

2001-07-16 $1,202.45 62.9 74.1 SHORT ($39.88)

2001-07-25 $1,190.49 63.7 42.5 LONG ($10.27)

2001-08-02 $1,220.75 100.0 100.0 SHORT $38.29

2001-08-16 $1,181.66 13.5 9.3 LONG $86.21

2001-08-28 $1,161.51 42.8 75.9 SHORT $6.82

2001-08-31 $1,133.58 12.8 9.8 LONG $82.83

[...]

2020-01-08 $3,253.05 22.8 13.4 LONG $633.19

2020-01-21 $3,320.79 70.1 81.6 SHORT $797.71

2020-01-28 $3,276.24 24.6 8.2 LONG $819.07

2020-02-18 $3,370.29 86.4 92.8 SHORT $962.62

2020-02-26 $3,116.39 0.0 0.0 LONG $1,376.37

2020-03-27 $2,541.47 87.3 95.8 SHORT ($27.37)

2020-05-14 $2,852.50 23.5 11.3 LONG ($74.51)

2020-05-21 $2,948.51 78.6 83.2 SHORT $428.54

2020-06-15 $3,066.59 19.7 10.6 LONG $96.37

2020-07-07 $3,145.32 73.8 86.8 SHORT $371.91

2020-07-27 $3,239.41 32.7 25.2 LONG $105.00

2020-08-07 $3,351.28 100.0 100.0 SHORT $422.83

More info

- Tutorial: Create a simple C# console app

- These files can also be found in the /docs/examples GitHub repo folder